Michigan Owner Operators are required to carry PIP, which inflates their truck insurance rate.

PIP is Personal Injury Protection that an Owner Operator purchases as part of his Trucking Commercial Auto Liability Insurance policy.

PIP insurance covers medical and other expenses for an Owner Operator and passengers no matter who is at fault.

In a No-Fault state like Michigan the injured party pays for their own injury expenses.

Here are the minimum PIP limits an Owner Operator must purchase in Michigan:

Michigan Owner Operator PIP Requirements

- $250,000 up to Unlimited

- includes PIP Work Loss and Replacement Services to a maximum of 85% of current wages for up to 3 years

- includes PPI – Property Protection Coverage up to $1 million per occurrence for damages to fixed objects inside MI

How much more does a Michigan Owner Operator pay for Truck Insurance because of PIP?

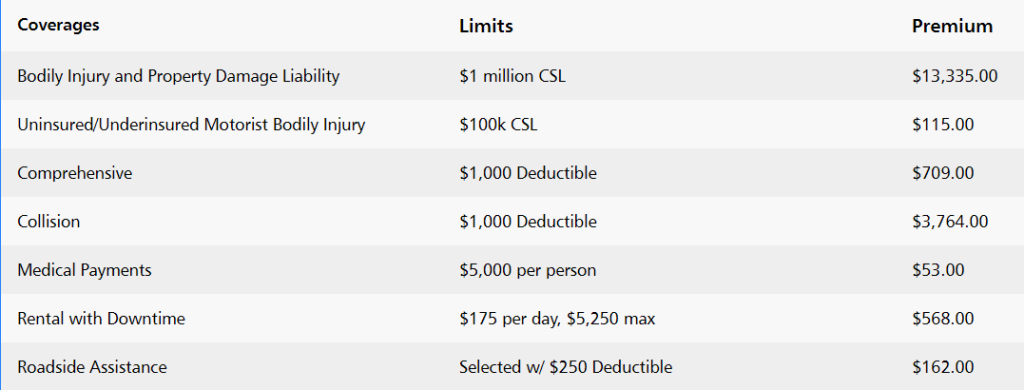

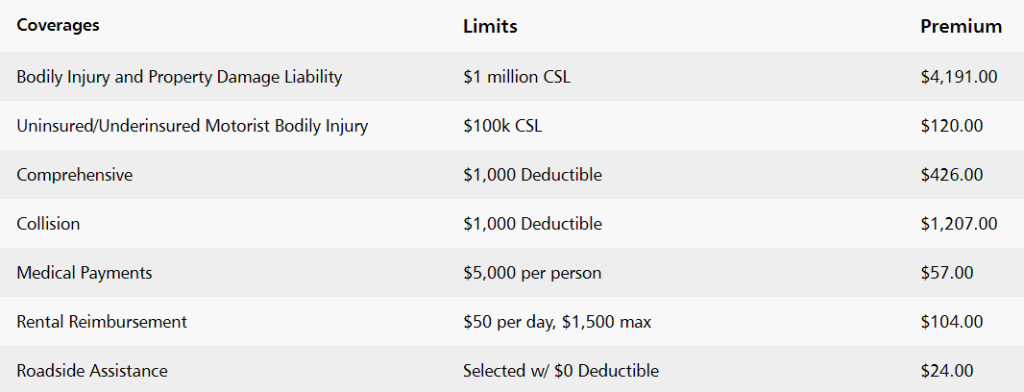

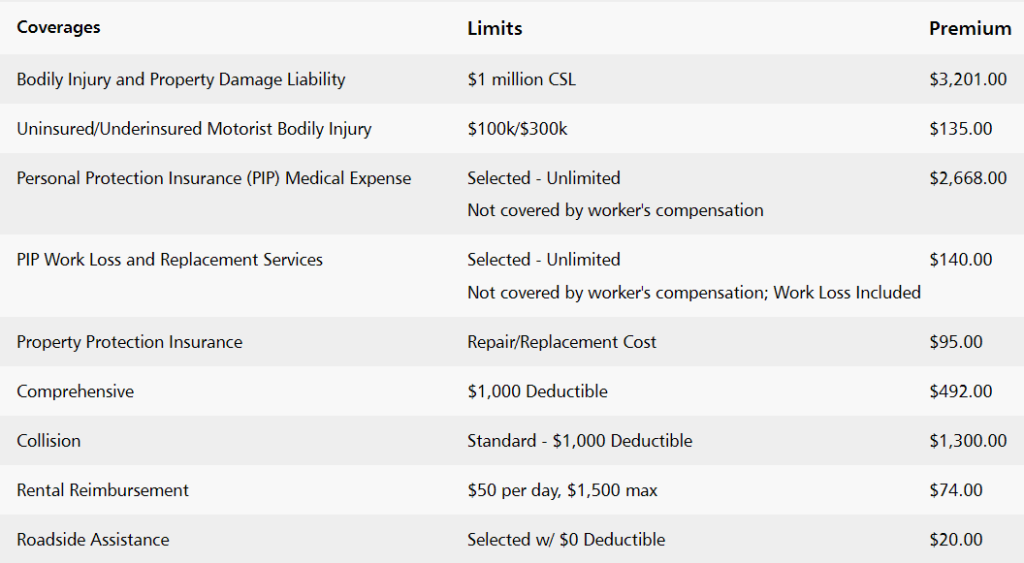

Example #1 Owner Operator Tractor with own DOT

$1,000,000 PRIMARY Commercial Auto Liability

OHIO vs MICHIGAN:

OHIO:

MICHIGAN:

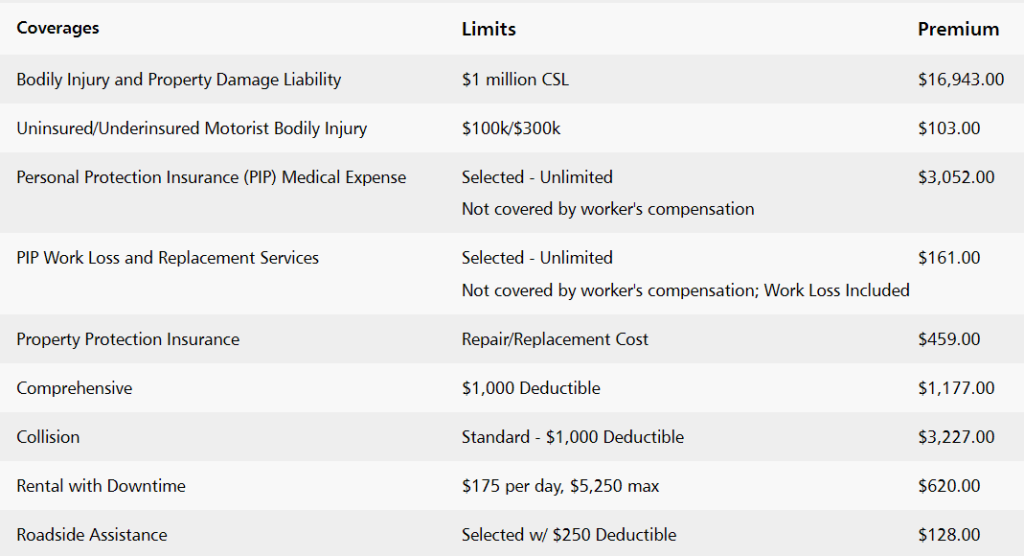

Example #2 Owner Operator Box Straight Truck leased on to a Motor Carrier

$1,000,000 NonTrucking Commercial Auto Liability

OHIO vs MICHIGAN:

OHIO:

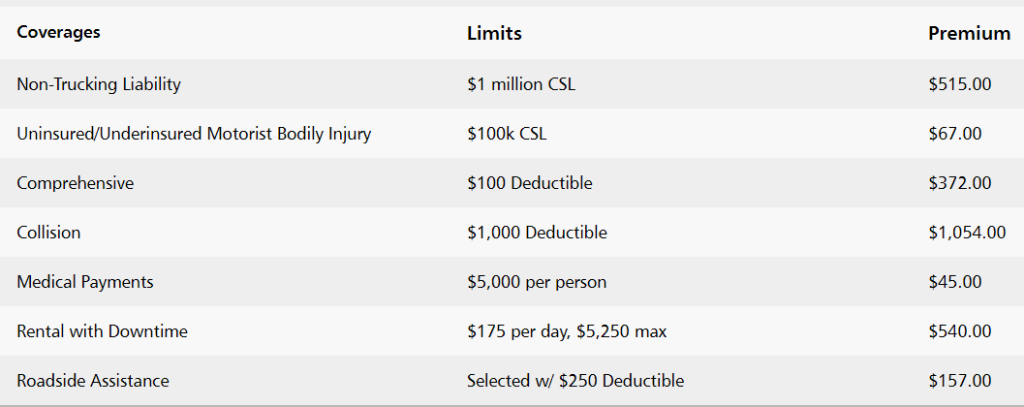

OH Example Straight Box Truck Insurance Rate

MICHIGAN:

What about Cargo Van Insurance or Sprinter Van Insurance?

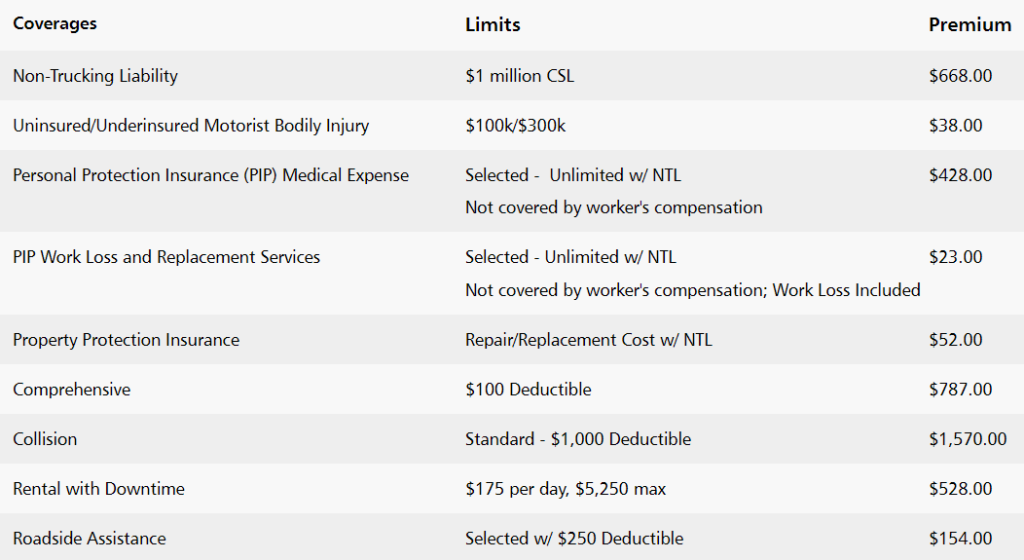

Example #3 Owner Operator Sprinter Cargo Van

$1,000,000 PRIMARY Commercial Auto Liability

OHIO vs MICHIGAN:

OHIO:

MICHIGAN:

For more comparison, there are other No-Fault States that require minimum PIP coverage for Owner Operators:

Florida

- $10,000 per person

- $5,000 death benefit

Hawaii

- $10,000 per person

Kansas

- $4,500 per person

- $4,500 for rehab

- $2,000 for burial

- $900 per month disability and lost wages for 1 year

- $25 per day for in home services for 1 year

Massachusetts

- $8,000 per person per accident

Minnesota

- $40,000 per person per accident

- $20,000 for medical

- $20,000 for non-medical

- $2,000 funeral

New York

- $50,000 per person

- $2,000 per month for up to 3 years for lost income

- $25 per day for 1 year for care

- $2,000 death benefit

North Dakota

- $30,000 per person

Utah

- $3,000 per person

- $250 or 85% of gross income per week for 1 year for lost wages

- $20 per day for 1 year for household services

- $1,500 per person for funeral expenses

- $3,000 death benefit

These states aren’t NoFault, but still require PIP or consider it optional coverage for Owner Operators:

Arkansas (optional PIP)

- $5,000 per person

Delaware (required PIP)

- $15,000 per person

- $30,000 per accident

- $5,000 funeral expenses

Maryland (optional PIP)

- $2,500

Oregon (required PIP)

- $15,000 per person

- $3,000 per month for 1 year for lost income

- $5,000 for funeral expenses

- $30 per day for household services for 1 year

- $25 per day for childcare up to $750

South Dakota (optional PIP)

- No minimum coverage requirement

Texas (optional PIP)

- $2,500 per person

Virginia (optional PIP)

- $2,000 per person

- $100 per week for lost wages for up to 12 months in some cases only

Washington (optional PIP)

- $10,000 per accident

- $2,000 for funeral expenses

- $200 per week for lost income up to $10,000

- $200 per week for household services up to $5,000

These states allow Owner Operators a choice on NoFault:

Kentucky (optional PIP & choice on NoFault)

- $10,000 per person per accident

New Jersey (required PIP & choice on NoFault)

- $15,000 per person per accident

- $250,000 for certain life altering injuries

Pennsylvania (required Medical Benefits & choice on NoFault)

- $5,000 per person per accident

For more help specific to you find your state DMV here, and FMCSA Insurance Filing Requirements here.

[Related story – What does Occupational Accident Insurance for Truckers Cover?]

This was 3 random examples of MI Owner Operators with Truck Insurance affected by PIP. These examples are to illustrate to Owner Operators the vast difference that can occur between states right next door to each other. Your own premium estimates will vary, of course.

To learn more read “What’s the Best State for Truck Insurance” here.

Then give us a call at CIS, we understand Owner Operators and Small Fleets. We are your advocate to help you succeed!

Authors

2002 Founder and CEO of Commercial Insurance Solutions, Inc., Shelly Benisch specializes in providing Commercial Truck Insurance for owner operators and small motor carriers. Both CIS and TRS certified, She also writes a free educational trucking insurance advice blog dedicated to the little guy.

Executive Director of Commercial Insurance Solutions, Inc., Christina Cummings leads her team in providing the best Truck Insurance with the best rates for Owner Operators and small Motor Carriers. Christina is TRS certified as a Transportation Risk Specialist. She is your "go to" person at CIS with questions, tips and networking opportunities in our trucking and expediting community.