In Michigan, Owner Operators have to carry PIP insurance, which can drive up their truck insurance rates.

So, what is PIP? It stands for Personal Injury Protection, and it’s part of your Trucking Commercial Auto Liability Insurance.

PIP covers medical bills and other expenses for you and your passengers, no matter who’s at fault in an accident.

Since Michigan is a No-Fault state, that means each person pays for their own injury expenses, which makes PIP essential.

What are Michigan Owner Operator PIP Requirements?

- $250,000 up to Unlimited

- includes PIP Work Loss and Replacement Services to a maximum of 85% of current wages for up to 3 years

- includes PPI – Property Protection Coverage up to $1 million per occurrence for damages to fixed objects inside MI

Is Ohio Cheaper than Michigan for Trucking Insurance?

Yep, Michigan’s a No-Fault State, but Ohio isn’t—and that’s one of the big reasons it’s so much cheaper than Michigan.

Here are 3 random examples of how much more a Michigan trucker pays compared to an Ohio trucker:

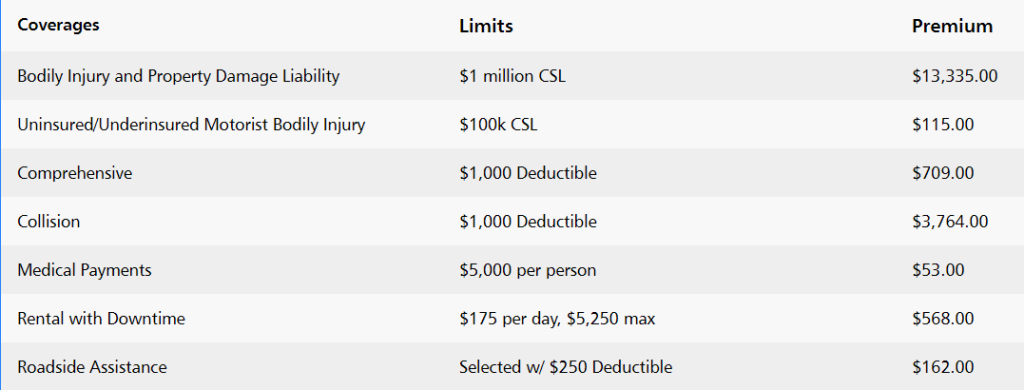

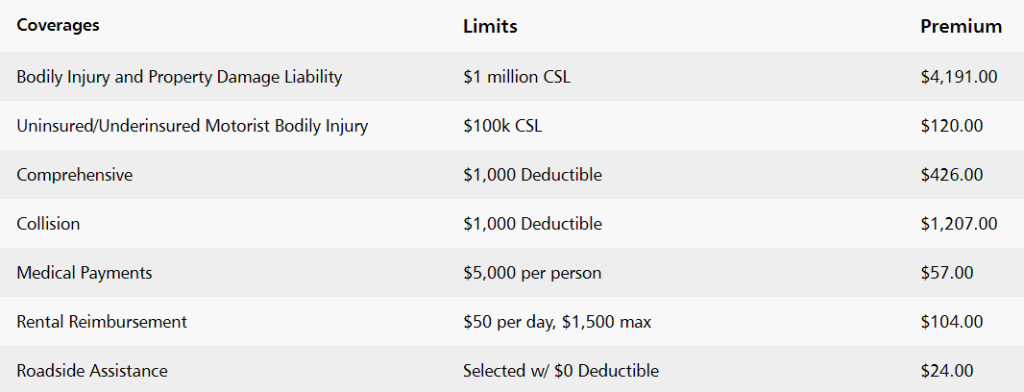

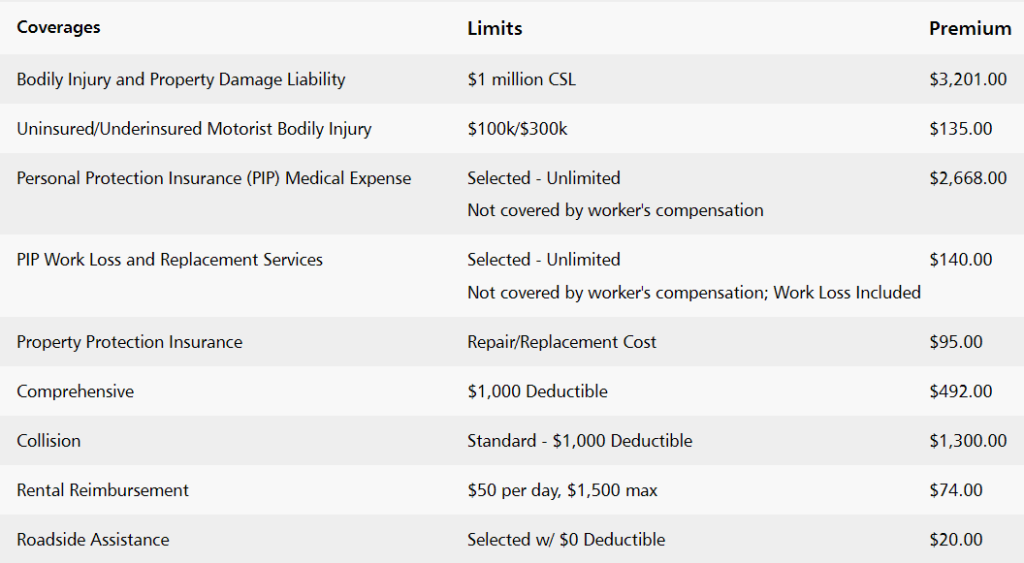

Example #1–Tractor Insurance

Motor Carrier with own DOT Authority

$1,000,000 PRIMARY Commercial Auto Liability–OHIO vs MICHIGAN:

OHIO:

MICHIGAN:

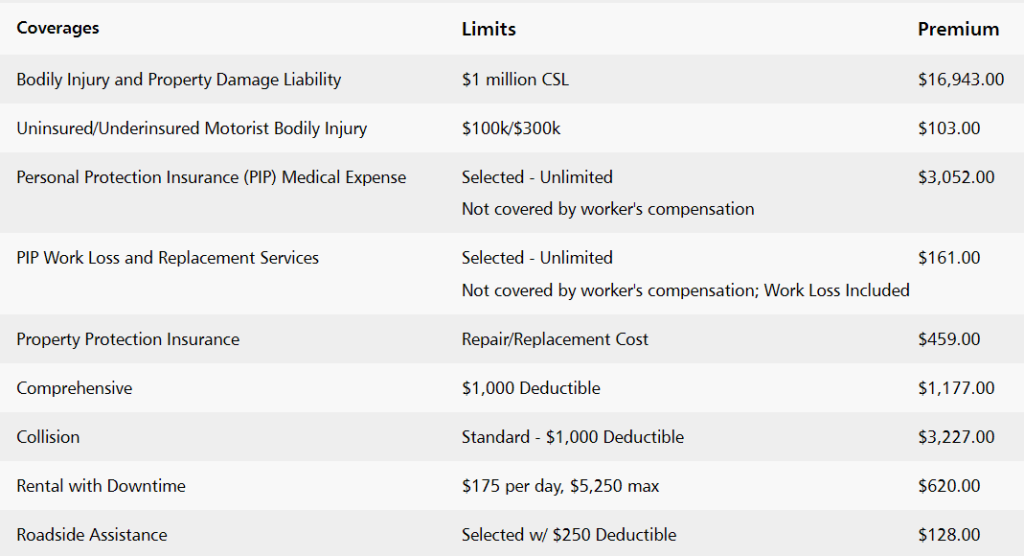

Example #2–Box Truck & Straight Truck Insurance

Owner Operator leased on to a Motor Carrier

$1,000,000 Non-Trucking Commercial Auto Liability–OHIO vs MICHIGAN:

OHIO:

MICHIGAN:

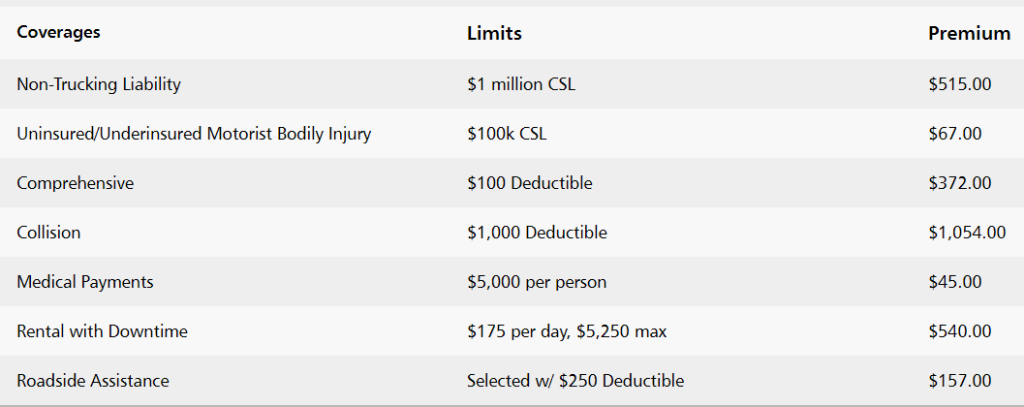

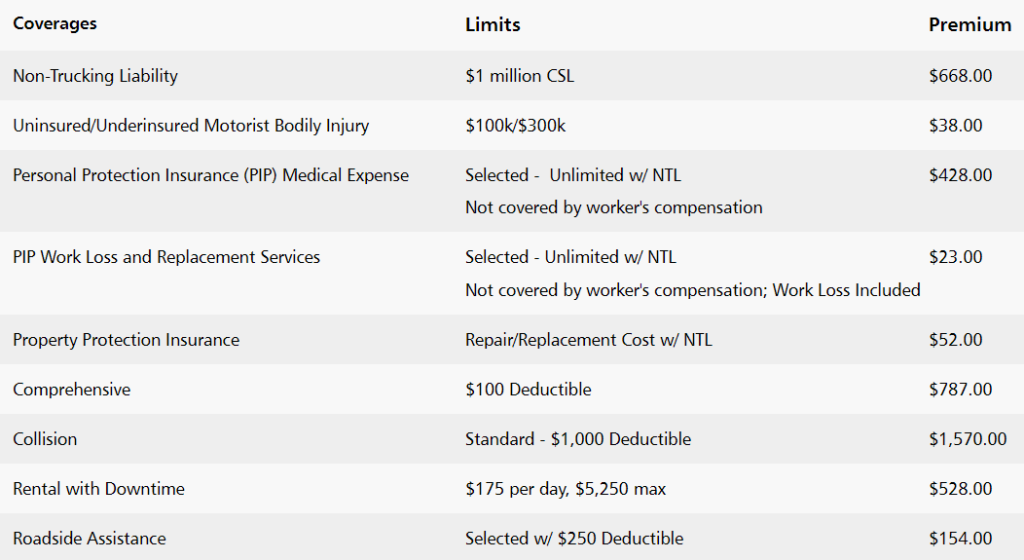

Example #3–Cargo Van & Sprinter Insurance

$1,000,000 PRIMARY Commercial Auto Liability–OHIO vs MICHIGAN:

OHIO:

MICHIGAN:

With such a difference in premiums, it might seem like a no-brainer to move your business from Michigan to Ohio or another state without PIP requirements. But it isn’t quite that simple once you look into what’s needed to prove you actually live there.

Check out What’s the Best State for Trucking Insurance to learn more!

You’ll see why often times it’s best to simply stay put:)

What’s the Best Way to Lower Your Michigan Truck Insurance?

Finding affordable commercial truck insurance is tough—and not just in Michigan. Insurance companies have been losing money on commercial auto for years (hard to believe–we know:)

With higher vehicle values and much larger payouts in liability cases, premiums aren’t as low as we’d like—but there are tricks to help you save.

Check out these 10 quick tips to lower your trucking insurance premium before your next renewal.

These tips are great whether you’re a seasoned trucker or just getting started as an owner-operator.

When it comes to getting started, we get tons of questions about setting up a new DOT motor carrier authority.

Now that the economy is finally lighting up again with more freight, we thought it’d be a great time to expand a bit more for newbies—

How to Start a Michigan DOT Motor Carrier Authority?

Well, it’s like the classic chicken-and-egg dilemma—what comes first, the insurance or the DOT?

- How do I get a DOT number?

- Why do I need motor carrier authority?

- When should I get truck insurance?

- How much insurance do I really need?

- What affects my premium?

- Why do I need $1,000,000 in liability coverage?

- Why isn’t FMCSA showing my correct insurance limits?

Sound familiar? Don’t worry—you’re not alone. Every new carrier has these same questions.

That’s why we put together a guide: Proven Tips to Save Money on Your New Motor Carrier Insurance.

It offers tips to save, but it’s also packed with answers to all those questions and more.

Plus, it links to our easy step-by-step cheat sheet– How to Get a Motor Carrier Authority.

You’ll also want links to FMCSA registration and MDOT–CVED Authority sites.

Guys, starting your own authority doesn’t have to be stressful when you get a little free help.

Get up to speed with a few hours of homework, and you’ll be rocking it as an independent trucker pro in no time!

Which Insurance Companies Cover New DOT Motor Carriers in Michigan?

For years, Progressive Commercial Truck Insurance has been the go-to choice for new startup Motor Carriers. They’ve been the reliable option when others couldn’t keep up after dealing with big losses.

But now, there’s a new player who’s gonna be shaking things up in Michigan very soon.

GEICO is rolling out a nationwide trucking insurance program aimed at small Motor Carriers. While it hasn’t launched in Michigan just yet, it’s already making waves in the other 40+ states with super competitive rates for both new and established carriers.

At CIS, we’re independent transportation insurance specialists representing both Progressive and GEICO.

So while GEICO isn’t available in Michigan as of this writing, it’s definitely on the way.

Curious about what they’ll offer you?

You can read more at GEICO Commercial Truck Insurance–Stay tuned!

Why Choose CIS for your Michigan Commercial Truck Insurance?

Just check out our 5-Star Reviews to see why so many new truckers choose–and stick with CIS.

Whether you need trucking insurance right away, or in the future. Give us a call or share some quick info online.

We can quote you now with Progressive and other carriers, and GEICO once they launch in Michigan.

–We’ll add you to our callback list.

That way, when GEICO launches in Michigan, you’ll be first in line to start saving.

And if the Wolverine State is anything like the other states GEICO’s rolled out in—you’ll be so glad you did!

Call CIS (330) 864-1511 or just click to start!

We are CIS, and We Make Your Truck Insurance Easy!

Authors

Shelly Benisch, CIC, TRS started Commercial Insurance Solutions, Inc. (CIS) in 2002 and brings over 30 years of experience in Commercial Truck Insurance. As one of the top 25 Progressive Truck Insurance Agency Leaders in 2024, she helps Motor Carriers and Owner Operators across the country find affordable trucking insurance quotes with GEICO, Progressive and more. Shelly also writes a free Trucking Blog packed with all kinds of tips. Her team of Truck Insurance Experts have earned CIS consistent 5-star reviews and Progressive's Top 25 Truck Elite Status. For expert Commercial Truck Insurance advice, give Shelly a call at (330) 864-1511

CEO

#CISDoesThat Commercial Truck Insurance for owner operators and motor carriers.Christina Cummings, TRS certified, leads Commercial Insurance Solutions, Inc. (CIS) as Executive Director and true experienced advice on Commercial Truck Insurance. She secures the most affordable GEICO quotes and Progressive quotes...and more for small Motor Carriers and Owner Operators nationwide. She is your "go to" person at CIS for advice with underwriting questions, tips and networking opportunities for Small Truckers. Under her leadership CIS earned Progressive's Top 25 Truck Elite status in 2024 and consistent 5-Star Google reviews. She also co-authors the free CIS Commercial Truck Insurance Blog for small Motor Carriers and Owner Operators, sharing her bottom line tips on how to find more affordable Commercial Truck Insurance. Looking for expert trucking insurance advice–Christina is your go to leader at (330) 864-1511 #CISDoesThat